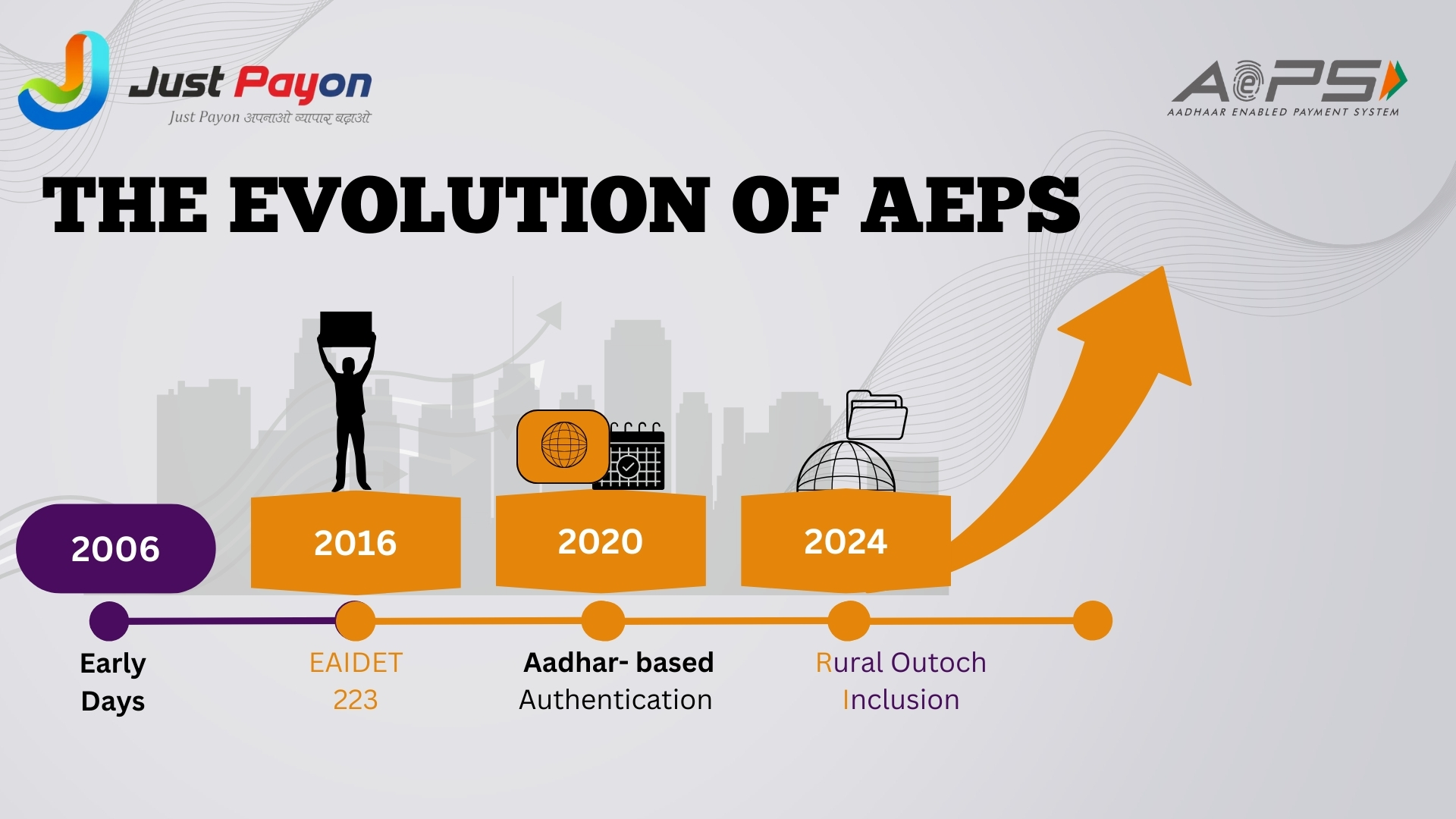

The Evolution of AEPS: From Its Launch to Today

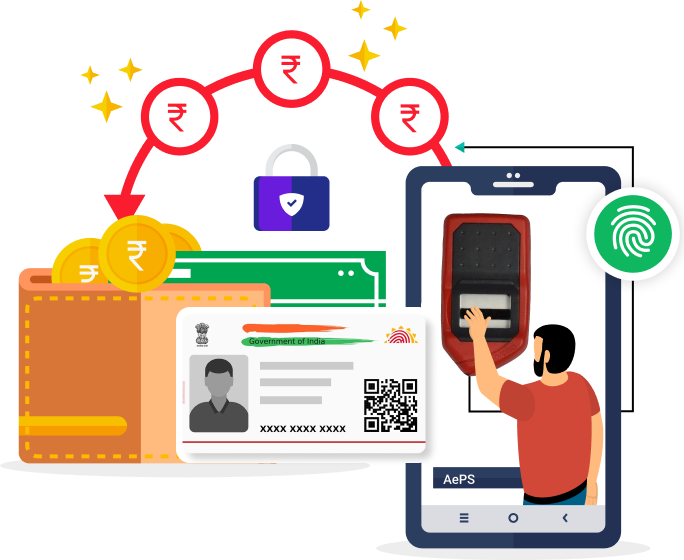

The Aadhaar Enabled Payment System(Aeps) is one of the best platforms for secure online transactions that makes the best aeps portal and best aeps service on JustPayOn. Aadhaar is a 12 digit alphanumeric unique identification of Indian.It plays vital role in identification of Indian especially for rural areas people and it is access banking transaction services without needing a bank branch or an ATM card.Let's dive into how AEPS evolved from day one to the present and see how it is still trying to meet India's ever-growing demand for digital financial services.

Contents of the Blog:

The Beginning: The Launch of AEPS

AEPS is a concept that was launched in 2016 under the Aadhaar based Payment System which was developed by the National Payments Corporation of India, NPCI. It used Aadhaar numbers, India's Unique Identification System for secure online transactions that is called as AEPS means an Aadhaar enabled payment system where a user can withdraw cash, check his balance, and transfer funds.

AEPs is part of the government's greater vision on financial inclusion, especially for those residing in rural areas who do not have access to traditional banking infrastructure. Through AEPS, customers could complete banking-related activities without an ATM card or internet banking access. It applied the biometric method of authentication, which differs from other digital payments such as UPI or credit card transactions.

Key Features of AEPS at Launch

Following are the features of AEPS at launch:

- Aadhaar Authentication: AePs used Aadhaar number and biometric authentication for online transactions. It is highly secure and easily accessible for people and it makes the best apes secure portal.

- Basic Banking Transaction: AEPs provides banking services like balance inquiries, cash withdrawals and fund transfers.

- Offline Transaction: APEs service do not have any internet connectivity or any mobile phones; it is only required for aadhaar linked bank account and biometric authentication.It is ideal for rural areas where network coverage is often poor.

- Financial Inclusion: AEPs play a vital role in banking services to people in rural and remote areas, and it does not have any internet connectivity.

Challenges Faced in the Early Stages

Following are the challenges faced by AEPS in early age:

The Growth Phase: Expanding Reach and Usage

AEPS started gaining transactions across the country. By 2017 and 2018, several key milestones were achieved that helped AEPS evolve:

- Wider Adoption by Banks: AEPs services are integrated by more banks allowing customers to use aadhaar linked accounts for financial transactions. The rural and urban banks networks deploy micro-ATMs and increase access to AEPS services for both urban and rural populations/li>

- Integration with Government Schemes: AEPs makes critical tools for Direct Benefit Transfer(DBT) programs. The Indian government used AEPs transactions in all government schemes.

- Focus on Biometric Authentication: AEPs transactions use biometric authentication that makes it more accessible and comfortable for AEPS transactions. It improves the success rate of transactions and descreas the issues related to biometric authentication.

- Introduction AEPS features: AEPs transactions introduced many services like withdrawals and transfer cash etc. APES provides E-KYC verification and Aadhaar based merchant payments.

Service offered by AEPS:

- Cash Deposit: APES provides cash deposit form existing account through biometric authentication and bank account linked with UID(Aadhar Card).

- Cash Withdrawal: Cash withdrawal is offered by using a bank account through biometric authentication and bank account linked to your Aadhaar Card.

- Balance Enquiry: AEPS offered balance enquiry of their account using biometric authentication.

- Fund Transfer(Adhar to Adhar): Money can transfer between two adhar linked accounts. It is most suitable for those people who have limited access to traditional bank accounts.

- Mini Statement: Customers can show their recent transaction to monitor recent activity.

- Bill payment: Customers can pay bills such as electricity bill, Gas bill etc from aadhar linked bank account using biometric authentication.

- Micro ATM service: Customers can use APES service as Micro ATM where banking performs transactions like withdrawal, deposit on behalf of banks.

- Aadhaar Seeding Status: We check our Aadhaar number linked with bank account, mobile number or other services.

These are services provides by JustPayOn and few document required for AEPS transaction Click Here!!

The Present Day: AEPS in 2024

In 2024 following are the features provided by AEPs that makes India’s digital payment solution:

The Future of AEPS: What Lies Ahead with JustPayOn?

AEPs moves towards greater digital inclusion, AEPS will play a vital role in all services in JustPayon. Here, are some possible development in the future:

- Expansion into New Markets: As infrastructure improves and more people get Aadhaar-linked banking services, AEPS will most likely expand into even more remote and underserved areas.

- Integration with Mobile Platforms: The usage of AEPS is primarily through micro-ATMs and POS devices. Going forward, integration with smartphone and mobile wallets could bring the service directly into the mobile apps.

- AI and Biometric Upgrade: As artificial intelligence and biometric technologies keep improving regularly, AEPS authentication will become more rapid and accurate, thus making the entire system friendly and reliable.

- Expanded Financial Services: In the future, there would be an extension to this application to offer even wider services such as insurance, loan disbursement, and investments, all made valid through Aadhaar authentication.

Conclusion

Launched in 2016, from then to now, and with the increasing adoption that it is experiencing in 2024, AEPS has made tremendous strides in changing the face of India's banking sector. This ability to function in low-connectivity areas, its security features, and its role in making financial inclusion possible have turned AEPS into one of the most important digital payment systems in India. It would prove to be an indispensable facilitator of the Indian digital economy, through which millions of people could get basic banking services and interact with the financial system.

We will, as the organizational growth evolves, help shape the future of banking and see the country move that much closer to a less cash-driven economy, ensuring no one is left behind in embracing the digital revolution.