Best AEPS ID for JustPayOn: Your Ultimate Guide to AEPS Services

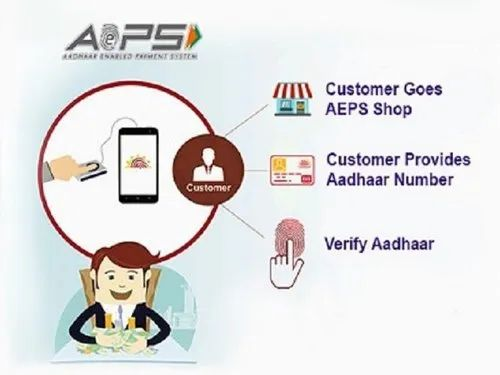

In a rapidly digitalizing world, the Aadhaar Enabled Payment System (AEPS) has emerged as a revolutionary platform, making banking services accessible to millions across the country. Whether you’re a small business owner or a service provider, securing the best AEPS ID can help you deliver essential financial services to your community. With AEPS, services like cash withdrawals, balance inquiries, and even mini-statements are made possible through Aadhaar-based authentication.

Among the various providers, JustPayOn stands out as one of the best AEPS portals available, offering top-tier AEPS services that are secure, reliable, and user-friendly. This guide will walk you through the benefits of getting an AEPS ID, why JustPayOn is the best choice, and how you can start delivering these vital services to your customers today.

Contents of the Blog:

What is AEPS, and Why is it Important?

AEPS is a payment system developed by the National Payments Corporation of India (NPCI) that enables people to access their bank accounts using Aadhaar authentication. Through AEPS, people can perform transactions such as:

- Cash Withdrawals

- Balance Inquiries

- Mini Statements

- Fund Transfers

AEPS is a game-changer for rural and semi-urban areas where banking infrastructure is often limited. With just an Aadhaar number and biometric verification, people can access their funds securely and quickly. For businesses, especially in underserved areas, having an AEPS ID is a powerful tool to enhance customer engagement, drive more foot traffic, and offer valuable financial services.

What is an AEPS ID?

What is an AEPS ID?

An AEPS ID is a unique identification code given to agents or merchants registered on an AEPS platform. This ID is linked to an Aadhaar number and allows authorized agents to perform AEPS services for customers. Essentially, an AEPS ID transforms your shop, office, or business location into a mini-banking point, empowering you to assist customers with their everyday banking needs.

With an AEPS ID from a reliable portal like JustPayOn, you gain access to a streamlined system that lets you handle multiple types of transactions safely and efficiently.If you can get AEPS Id then CLick Here!!

Why Choose JustPayOn for the Best AEPS ID?

When it comes to selecting an AEPS provider, JustPayOn is known for being one of the best AEPS portals available, offering reliable, secure, and cost-effective solutions. Here’s what sets JustPayOn apart:

- Robust Security Features:JustPayOn prioritizes transaction security by incorporating advanced encryption and biometric verification systems to protect customer data and ensure safe transactions. This makes JustPayOn one of the best AEPS services for those looking for a secure AEPS platform.

- User-Friendly Interface:JustPayOn’s AEPS portal is intuitive, making it easy for agents and merchants to navigate the interface, access services, and resolve customer queries. The streamlined interface allows you to focus on customer experience without technical hurdles.

- Free Registration:JustPayOn offers free registration for AEPS IDs, which makes it accessible to small businesses and individual agents looking to start their AEPS services with minimal investment.

- Comprehensive Customer Support:Reliable customer support is critical for uninterrupted service. JustPayOn provides dedicated customer support to assist with troubleshooting, transactions, and other inquiries, ensuring that agents can provide smooth, efficient service to their clients.

- Diverse Range of AEPS Services:JustPayOn’s AEPS ID allows you to offer multiple services, from cash withdrawal to mini statements, which can draw more customers and increase footfall.

By choosing JustPayOn, you are partnering with one of the best AEPS service providers, enabling you to enhance your business offerings and earn customer loyalty.

How to Obtain the Best AEPS ID with JustPayOn

Starting with an AEPS ID through JustPayOn is straightforward. Follow these steps to register and activate your ID:

- Visit the JustPayOn Website: Go to the official JustPayOn website and navigate to the AEPS registration section.

- Complete the Registration Form: Fill in your details, including your Aadhaar number, business information, and contact information. Registration is free, making it an accessible option for businesses of all sizes.

- Submit Biometric Authentication: AEPS requires biometric verification to ensure that only authorized individuals can access the platform. This security feature adds a layer of safety for both agents and customers.

- Receive Your AEPS ID: Once registration and verification are complete, you’ll be assigned an AEPS ID. This ID will serve as your unique identifier, allowing you to perform secure transactions on behalf of customers.

- Access AEPS Services: With your AEPS ID activated, you can start processing transactions right away, offering cash withdrawal, balance inquiries, mini statements, and more.

AEPS ID Benefits: Why Having the Best AEPS ID Matters

Having the best AEPS ID can significantly benefit your business by opening up multiple revenue streams and providing essential services to your customers. Here are some key benefits:

- Increased Foot Traffic:Offering AEPS services can attract more customers to your store or business, increasing foot traffic and brand visibility.

- Additional Revenue Streams:Agents earn commissions for each AEPS transaction. With a reliable AEPS ID, you can turn your business into a profitable banking point.

- Community Service:For many rural communities, AEPS services provide an accessible way to manage finances without traveling to a distant bank branch. This service builds goodwill and strengthens customer relationships.

- Enhanced Credibility:As an authorized AEPS agent with JustPayOn, you establish your business as a trustworthy provider of banking services, boosting your reputation and credibility.

- Low Operational Costs:With free registration and minimal setup costs, JustPayOn’s AEPS ID provides a low-cost solution for adding value to your business.

Optimizing Your Business with JustPayOn’s AEPS Services

With your AEPS ID in hand, here’s how you can maximize its value:

- Promote Your AEPS Services Locally: Spread the word in your community. Inform people that they can access banking services through your business. Use posters, banners, and social media to let potential customers know about the convenience you offer.

- Expand Service Offerings: Apart from AEPS, consider offering other services like bill payments, mobile recharges, and money transfers. This diversification can increase customer engagement and provide additional income sources.

- Invest in Customer Experience: Providing quick, hassle-free service is essential for customer satisfaction. Be patient with customers, especially if they’re new to AEPS. Offer clear instructions and help them feel comfortable with the process.

- Stay Updated on AEPS Trends: The digital finance landscape is evolving rapidly. Keep track of new AEPS features or services JustPayOn may introduce, and leverage them to keep your offerings current.

Final Thoughts

In a world where digital financial services are becoming indispensable, securing the best AEPS ID is a strategic step for businesses and entrepreneurs alike. By choosing JustPayOn as your AEPS service provider, you gain access to a platform that is secure, reliable, and designed to enhance both customer experience and business growth.

If you’re looking for an opportunity to expand your business offerings, increase footfall, and support your community, getting an AEPS ID with JustPayOn is an excellent choice. With its free registration, advanced security, and robust support, JustPayOn’s AEPS portal is the ideal platform to help you achieve these goals.