A Complete Guide to Aadhaar Seeding: Understanding the Process and Benefits

In the digital age, ensuring seamless access to financial services has become a priority for both individuals and government institutions. One of the crucial steps towards achieving this is Aadhaar seeding. Aadhaar seeding is the process of linking your Aadhaar number with various financial services, including bank accounts, mobile numbers, and government schemes. The seeding process plays a pivotal role in enhancing security, streamlining transactions, and promoting financial inclusion.

In this guide, we will walk you through the Aadhaar Seeding Process, explain how to seed Aadhaar with your bank account, and explore the secure Aadhaar seeding process. Additionally, we will dive into the importance of Aadhaar seeding in digital payment systems and show you how to check your Aadhaar Seeding Status and complete Aadhaar Seeding Verification. Let's explore these aspects in detail, while also highlighting how JustPayOn helps in facilitating a smoother Aadhaar seeding experience for its users.

Contents of the Blog:

- What is Aadhaar Seeding

- Aadhaar Seeding Process: A Step-by-Step Guide

- How to Seed Aadhaar with Bank Account: A Detailed Process

- Secure Aadhaar Seeding Process: Best Practices

- Aadhaar Seeding Online: How to Complete the Process Digitally

- How to Check Aadhaar Seeding Status:

- Aadhaar Seeding Verification: Why It’s Important

- The Role of Aadhaar Seeding in Digital Payment Systems

- Conclusion:

What is Aadhaar Seeding

Aadhaar seeding is the process of linking an individual's Aadhaar number to various financial and non-financial services. It is a crucial step for availing benefits from government schemes, receiving subsidies, and even conducting financial transactions through digital platforms. The objective is to create a digital ecosystem where the Aadhaar number serves as a unique identifier, ensuring that services are provided to the right individuals

The process involves providing your Aadhaar details to the concerned authorities (banks, government departments, or service providers), who then seed or link your Aadhaar number to your account or service.

Aadhaar Seeding Process: A Step-by-Step Guide

The Aadhaar seeding process is relatively simple but requires attention to detail to ensure that the seeding is done correctly. Here’s a step-by-step guide to help you understand the process:

- Link Aadhaar with Bank Account:Many banks allow you to link your Aadhaar number to your bank account online. You can log in to your bank's official website or mobile banking app and provide your Aadhaar number in the designated section under 'Aadhaar Seeding'.If you prefer to do it offline, visit your bank branch with your Aadhaar card. Fill out the Aadhaar seeding form and provide it along with a copy of your Aadhaar to the bank representative for processing.

- Link Aadhaar with Mobile Number: To link your Aadhaar number to your mobile number, you can visit your mobile service provider’s store and complete the process. The mobile provider will verify your identity with your Aadhaar details.

- Link Aadhaar with Government Services: Aadhaar seeding is also a requirement for availing subsidies, welfare benefits, and government schemes. You can link your Aadhaar to government platforms like the Direct Benefit Transfer (DBT) for efficient fund transfer.

How to Seed Aadhaar with Bank Account: A Detailed Process

Linking your Aadhaar number to your bank account is one of the most common forms of Aadhaar seeding. Here is a detailed look at how you can do it:

Online via Internet Banking:

- Login to your internet banking account.

- Locate the Aadhaar seeding option under the 'Accounts' or 'Profile' section.

- Enter your Aadhaar number and submit.

- The bank will verify the information and complete the seeding.

Bank Branch Visit:

- Visit your bank's branch and request the Aadhaar seeding form.

- Fill out the form with your correct Aadhaar number and account details.

- Submit the form along with a copy of your Aadhaar card for verification.

Through ATMs (For Some Banks):

- Some banks offer the option to link Aadhaar with your bank account via ATM machines.

- Select the Aadhaar linking option and follow the instructions provided on the ATM screen.

Secure Aadhaar Seeding Process: Best Practices

While Aadhaar seeding is a relatively safe process, it is essential to follow certain security practices to ensure that your information remains protected. Here’s how you can ensure a secure Aadhaar seeding process:

- Use Trusted Platforms: Always use official or trusted platforms to complete the Aadhaar seeding process. Avoid third-party services or websites that might compromise your personal data. If you are using digital platforms like JustPayOn, ensure that the site uses secure connections (look for "https://" and a padlock symbol in the URL).

- Beware of Phishing Attacks: Be cautious of emails, messages, or calls that ask for your Aadhaar number or other personal details. These could be phishing attempts to steal your information. Always verify the source before responding.

- Enable Two-Factor Authentication (2FA): For online banking and Aadhaar seeding, always enable two-factor authentication. This adds an extra layer of security to your accounts, reducing the risk of unauthorized access.

- Avoid Public Wi-Fi: When linking Aadhaar to any financial service, avoid using public Wi-Fi networks. Use a secure, private network to ensure that your data is not intercepted.

Aadhaar Seeding Online: How to Complete the Process Digitally

With the increasing adoption of digital services, Aadhaar seeding can also be completed online. The process is simple, quick, and convenient, and it can be done from the comfort of your home. Here’s how you can complete Aadhaar seeding online:

- Bank Websites/Apps: Most banks offer an online facility to link your Aadhaar number with your bank account. Log in to your bank’s website or app, enter your Aadhaar details, and complete the verification process through an OTP sent to your registered mobile number.

- Aadhaar Self Service Update Portal (SSUP): The UIDAI provides a Self Service Update Portal where you can update your Aadhaar details or link it to other services online. Visit the portal, enter your details, and follow the instructions to complete the process.

- JustPayOn’s Seamless Process: JustPayOn offers a secure and efficient platform to facilitate Aadhaar seeding. Through its digital payment systems, you can link your Aadhaar number with various services, making transactions faster and more secure.

How to Check Aadhaar Seeding Status:

To know if your Aadhaar has been successfully linked to your bank account or other services, you can check your Aadhaar seeding status. Here's how:

- Bank Websites/Apps:Many banks allow you to check the Aadhaar seeding status through their online portals or apps. Login to your account, go to the 'Aadhaar Seeding' section, and check the status.

- Aadhaar Authentication Portal:Visit the official UIDAI portal and use the Aadhaar Authentication feature to check whether your Aadhaar has been linked to any government services or financial institutions.

Aadhaar Seeding Verification: Why It’s Important

Aadhaar seeding verification ensures that your Aadhaar number has been correctly linked to your bank account, mobile number, or government schemes. It helps prevent fraud, ensures that benefits are accurately transferred, and allows you to use digital services smoothly. Verification is done through an OTP (One Time Password) or biometric authentication, depending on the service provider. It is important to verify the seeding status to avoid any issues in accessing services.

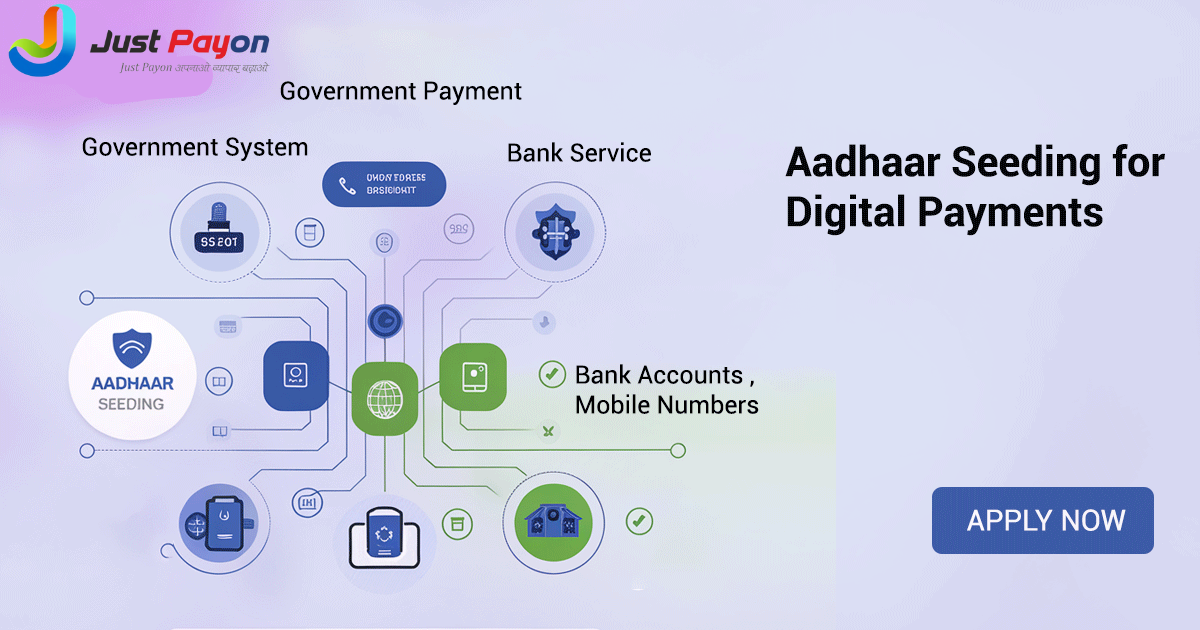

The Role of Aadhaar Seeding in Digital Payment Systems

Aadhaar seeding plays a pivotal role in the smooth functioning of digital payment systems. By linking your Aadhaar number with your bank account, mobile number, and other services, you enable yourself to make secure, instant, and cashless transactions.

- AEPS (Aadhaar Enabled Payment System): AEPS allows individuals to perform basic banking transactions such as cash withdrawals, balance inquiries, and fund transfers using their Aadhaar number. Aadhaar seeding is a prerequisite for AEPS transactions.

- Digital Wallets and UPI: Aadhaar seeding also supports the linking of your Aadhaar with digital wallets and UPI platforms, allowing for faster and more secure transactions.

JustPayOn’s secure and easy-to-use platform leverages Aadhaar seeding to ensure that users have seamless access to all digital payment systems, enabling a smoother and more efficient experience.

Conclusion:

Aadhaar seeding is a vital step towards creating a fully digital and inclusive financial system. By linking your Aadhaar with various services, you not only make your transactions faster but also ensure that you can access government schemes and other essential services. Through platforms like JustPayOn.